01 Aug, 2023

Startups across the globe are relentlessly striving to offer groundbreaking solutions and create value for their users. However, to keep the innovation engine running smoothly, it’s crucial for these firms to identify and implement effective startup monetization strategies. The right monetization strategy not only drives revenue growth but also facilitates the startup’s long-term expansion and sustainability. This holds true—and often with increased gravity—for startups in the artificial intelligence (AI) sector due to its relatively higher technology development costs and complex deployment scenarios.

Recent industry reports highlight the significant growth potential within the AI sector, making startup monetization a topic that garners consistent attention from entrepreneurs, investors, and industry analysts. Consider this - custom AI solutions generated a staggering $12 billion in revenue in the past year, marking a substantial 25% YoY growth. With such impressive numbers, it’s evident that AI startups present a strategic point of interest for stakeholders in terms of return on investment (ROI).

This blog post aims to demystify startup monetization strategies leveraging case studies of the most valuable AI startups. We’ll also explore the risks and rewards associated with investing in AI startups, with a close look at the rapidly increasing valuations and the high ROI that smartly designed AI projects can offer. So, whether you’re an aspiring entrepreneur considering an AI startup venture or an investor seeking an ROI above the industry average, read on to gather practical insights and actionable advice.

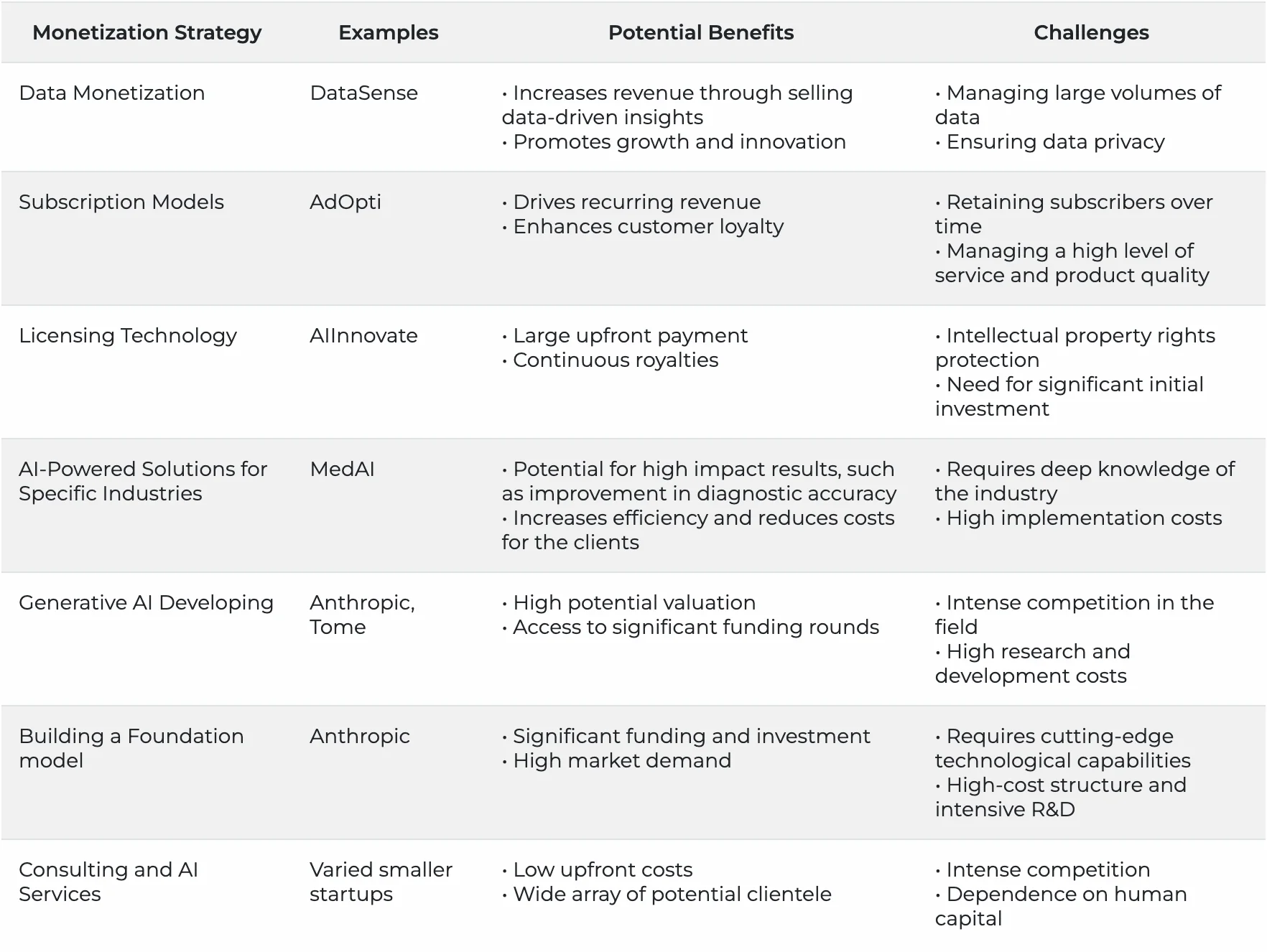

AI startups lead the digital revolution with their innovative solutions. Monetizing these groundbreaking solutions, however, often demands strategies that are as innovative as the AI technology itself. Let’s review three of these crucial startup monetization strategies: data monetization, subscription models, and technology licensing.

Data — it’s the lifeblood of the digital era, and when correctly harnessed, it can become a potent revenue engine for AI startups. Data monetization involves transforming customer behavior data into actionable insights to drive marketing strategies via intelligent AI algorithms.

An excellent embodiment of this model is DataSense, led by Captain Maria Martinez. Martinez states: “We slice and dice data, transforming it into actionable insights. We charge clients based on data volume and complexity. It’s not just data; it’s dollars.”

Through their data monetization efforts, DataSense assisted an e-commerce company in optimizing its marketing strategies, leading to a whopping 40% increase in conversion rates. This optimization did not only boost the client’s revenue but also generated a significant income stream for DataSense.

Another popular monetization strategy for AI startups is the subscription model. These models provide consistent, recurring revenue, and in the AI market, they’ve grown massively popular, boasting a 40% increase in adoption over the past two years.

Alex Johnson, AdOpti’s chief architect, emphasizes the value of these models: “Our subscription model keeps our clients ahead of the game. We’ve seen a whopping 30% YoY growth in recurring revenue.” AdOpti utilizes AI-powered marketing solutions, and their success underscores the potency of subscription models in the AI industry.

Licensing is a savvy way for AI startups to monetize their innovative solutions. In this model, startups license their technology to larger companies, resulting in an upfront or ongoing licensing fee.

AIInnovate provides a prime example of this revenue avenue, having licensed their innovative chatbot technology to global e-commerce giants for a considerable $5 million in licensing fees.

Each of these strategies — data monetization, subscription models, and technology licensing — provides AI startups with viable means of turning their innovation into income. The choice ultimately depends on the startup’s unique technology, market, and goals, but one thing remains constant: savvy monetization strategies are key to commercial success in the AI industry.

While data monetization, subscription models, and technology licensing are core to many AI startups’ monetization strategies, there are several other ways AI startups can generate revenue, thus aiding their financial growth and stability.

Startups can monetize their AI technology by offering APIs (Application Programming Interfaces) to third parties. This allows other companies to consume and utilize the AI services in their own products or services. The API can be monetized based on usage, i.e., the startup can charge based on the number of API calls. For instance, if an AI startup has developed a powerful image recognition system, it can provide an API for this system and charge developers per API call.

AI startups can also choose to offer a freemium model, where basic features are offered for free but advanced features are available for a fee. This approach not only allows companies to attract a user base but also to generate revenue from those who are willing to pay for enhanced features or services.

White-labelling involves selling the startup’s AI products under another company’s brand. This strategy enables other businesses to utilize and sell the AI technology as their own, providing the startup with a broader market reach and additional revenue.

Some AI startups that collect a significant amount of data can even sell anonymized versions of this data to interested parties. While this strategy needs to be executed with extreme care to avoid privacy issues, organizations across various industries are always looking for large data sets to inform their tactics or strategies and are willing to pay significant amounts for this data.

By considering these additional monetization methods, another layer of revenue streams could be produced, further ensuring that AI startups thrive in the dynamic digital marketplace.

The world of AI startups is not only about unique ideas and technological advancements. It also includes a profoundly competitive business dimension where Return On Investment (ROI) plays a crucial role. In this context, ROI measures the efficiency and profitability of the startup’s investments.

For instance, best-in-class corporations enjoy a remarkable 13% ROI on AI projects—more than twice the average ROI of 5.9%. . Such lucrative ROI rates demonstrate the potential rewards that investors can reap from strategic and well-calculated investments in AI startups.

Now, let’s take a closer look at some prominent AI startups and their remarkable initiatives and ROI.

OpenAI offers a stellar example of an AI startup generating impressive ROIs. Founded in 2015, OpenAI is a research organization focused on ensuring that artificial general intelligence (AGI) benefits everyone.

As per Crunchbase, OpenAI recently closed a $300M share sale at a valuation of $27B-$29B. This enormous valuation significantly ups the stakes for prospective investors, corroborating the immense growth and revenue potential of AI startups.

Moreover, OpenAI’s recent forecasts show an impressive growth trajectory, with an expectation of $200M in revenue in 2023 and an ambitious $1B by 2024. Over its 7 funding rounds, OpenAI has already raised $11.3B, signaling investors’ confidence in its potential.

The disruptive nature of AI technology and the success stories of startups like OpenAI are driving considerable investor interest. As a result, pre-money valuations of AI startups are soaring.

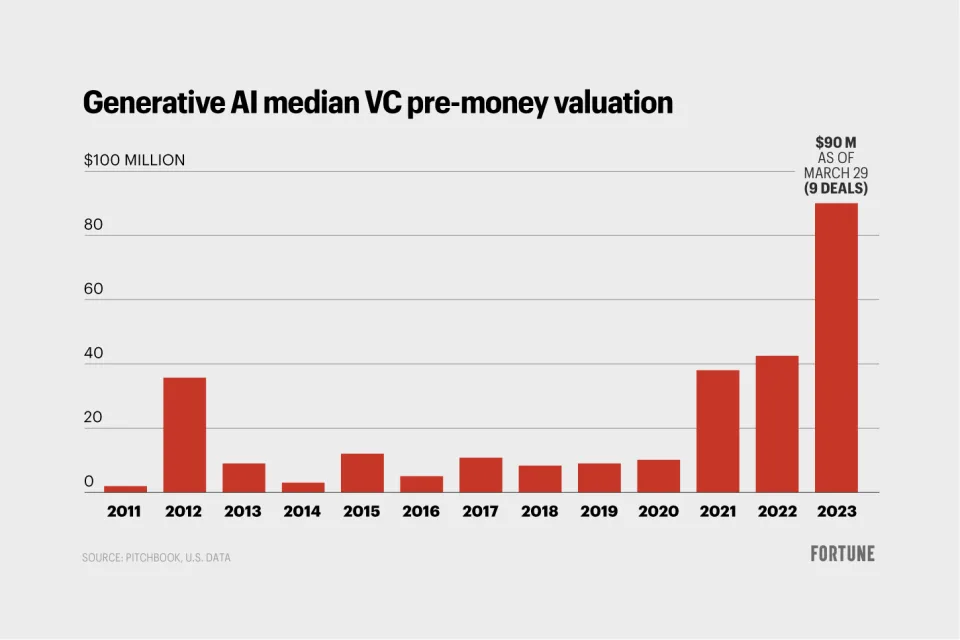

In 2023, the median pre-money valuation for generative A.I. firms rose to $90M, up from $42.5M for 2022. These higher valuations result from substantial deals by startups such as Tome and Anthropic, which recently raised $300M at a $4B pre-investment valuation.

The market outlook for these AI startups is also positive, with PitchBook analysts predicting a 32% compound annual growth rate (CAGR) potentially leading the market to a whopping $98.1B by 2026.

It’s essential to note, however, ROI in AI startups, while promising, isn’t guaranteed. Like any investment venture, it involves risks and uncertainties. Nevertheless, the potential rewards, as evidenced by startups like OpenAI, are enticing and compelling for forward-looking investors ready to ride the wave of AI innovation.

Investing in AI startups is not without its risks and challenges, but it also displays an array of promising opportunities.

It is a harsh but important reality to grapple with that a considerable number of startups do not thrive or deliver significant profits to their investors. According to estimations, around 70% of startups fail to realize their full potential, with only a minute fraction ascending to extraordinary unicorn status. The MPost Team conducted an insightful study, revealing the 12 most common reasons leading to the downfall of AI startups. These encompassed a broad spectrum of issues, from overestimating the scalability of their AI solution to ineffective marketing strategies and unforeseen legal and regulatory challenges. Understanding these potential pitfalls is crucial for any emerging AI startup to ensure they pave a successful pathway and avoid common missteps.

While startups present their share of risks, they also prove to be fertile ground for immense opportunities. This is especially the case for AI startups. As of Q2 2023, we’ve already seen a record year with equity funding topping $14.1B across 86 deals in generative AI startups. This optimistic trend is underpinned by rapid growth in pre-money valuations. According to Fortune, the median pre-money valuation for generative AI firms soared to $90 million in 2023, an over twofold increase from the $42.5 million experienced in 2022. Significant deals for firms like Anthropic and Tome have fueled this surge in investment and valuation.

In the words of Brendan Burke, a senior emerging technology analyst at PitchBook, “investor momentum is on early-stage startups in this new wave of AI”. Interestingly, startups operating on “foundation models” such as Anthropic, which reportedly raised $300 million at a near $4 billion pre-investment valuation, command some of the loftiest valuations.

Bolstering this optimistic trend, PitchBook analysts predicted that at a 32% compound annual growth rate (CAGR), the AI market could reach a staggering $98.1 billion by 2026.

However, as with any bold venture, it’s critical to exercise thoughtful discernment. Balancing risks and opportunities, leveraging best-practice startup monetization strategies, and thoroughly scrutinizing unit economics are all fundamental elements of investing in AI startups. After all, an ideal ratio of customer lifetime value to customer acquisition is 3:1, where each new customer brings three times the value of acquisition.

Comparing this to the average ROI on AI projects, which stands at 5.9%, and against best-in-class corporations reaping a 13% ROI on AI projects, it becomes clear that the world of AI startups is a challenging yet promising panorama of risks and possibilities.

As we’ve explored, monetization strategies are integral to the success of AI startups. Custom AI solutions are on the rise, with the industry’s revenue reaching an impressive $12 billion in the last year. Whether through data monetization, subscription-based services, or licensing agreements, AI startups have discovered a number of ways to generate significant revenue. Plus, these monetization strategies are attracting hefty investments and propelling startups towards record-breaking valuations.

However, it’s crucial to bear in mind that the AI startup scene is fraught with risks. With approximately 70% of startups failing to thrive or deliver substantial profits, founders must craft a robust business strategy – one that not only drives innovation but also assures profitability and sustainability.

The key takeaway is that the path to monetization doesn’t follow a one-size-fits-all approach. Careful consideration of factors like your target market, offerings, and growth potential are instrumental in selecting the apt monetization strategy. As the AI landscape continues to evolve, so will the possibilities for revenue generation and growth.

Stan and his team are expert blockchain developers with excellent full stack experience and I can't recommend them enough! The work is high quality, communication is excellent, and they are available at all times to connect live to discuss key project decisions in real time and to provide regular progress updates. For someone with limited development experience, Stan was also very willing to help walk through key architecture decisions in a way that was easy to understand and that made the process very smooth. In addition to being great at blockchain development, Stan and his team also have excellent startup business experience and we regularly had in-depth strategy discussions where Stan served as a trusted advisor to brainstorm product features, customer segmentation, go to market, and launch strategy for a blockchain startup. If you're looking for an excellent blockchain development team, full stack development resources, or a trusted startup advisor, these are the guys!

Read full testimonial

When initially looking for a team for this build the interview process was paramount. within minutes Stan had me at a comfortable spot knowing we would be in the best care, we have been working together for months. this team & stan especially are top tier. we have had hard thought discussions around smart contract development, optimization, payments, routing of transactions, ecosystem architecture, design. this team solves problems so you wont have to. apart from being entirely flexible im at ease knowing the team is efficient with top quality full stack work.

Read full testimonial

Michael is very knowledgeable in his area. He delivered the work within a very quick time period but equally took time to provide the necessary support that came with building the decentralised app script. I would recommend him to any other client on upwork. I just hope that he doesn't get soo much work that he can't work with me again.

Read full testimonial

Great communication from the team. The finished Coinbase Wallet reader script works great and we were able to adapt it to our specific needs.

Read full testimonial

The platform met our expectations. Pragmatic DLT's team provides transparent communication, and are skilled experts in blockchain. Their effective project management and responsiveness have facilitated the potential for a long-term partnership.

Read full testimonial

Great communication and attention to detail, the design process went really smoothly and the results were excellent.

Read full testimonial

Michael and team completed backend development of my web3 app in 1 week where it took months for others to complete the same work. The quality was high and well-documented. This team is my go-to resource for future blockchain development.

Read full testimonial

Very uncomplicated to work with. Did the job well and exactly as requested.

Read full testimonial

Pragmatic DLT offered helpful, transparent advice about blockchain technology and data security. Their clear communication and efficient Agile methodology set them apart.

Read full testimonial

They ultimately surpassed our initial expectations. The MVP was delivered within the agreed timeframe and scope, and the design that Pragmatic DLT implemented processes one order per second for more than 2,000 worldwide merchants. The team had a proactive approach, was responsive to the client's needs, and took ownership of their work

Read full testimonial

Everything was very good! The team managed the engagement effectively and fixed errors prior to the launch. Moreover, their resources were highly competent. Overall, the project was a success.

Read full testimonial

Michael and the team did an amazing job! I am pretty demanding customer and the project was not a trivial one. Mike, however, jumped on the task and a) Captured my requirements really well. Guys put it on paper and in the meantime I happen to better understand what I wanted than ever before. I am so grateful they saw my perspective and put it in a perspective of technical viability. b) Delivered very clear and concise architecture. Now I am very clear on how the big project may look and how much will it cost. Finally the thing I am grateful the most. Guys didn't push me to buy the development, they really rose the challenges and questions of viability in a manner I would never be able to do myself. And, effectively, talked me out of the project! They are true professionals and I can now fully trust that they would not sell me solutions they don't believe in. Absolutely recommended!

Read full testimonial